Top 10 AI Marketing Apps & Benefits – Power of Artificial Intelligence

2 years agoBreaking News: Nepal Imposes Taxes on Facebook!

2 years ago -

In recent times, the digital landscape has been witnessing remarkable shifts, and the latest development that has captured the attention of individuals and businesses alike is Nepal’s decision to impose taxes on Facebook in Nepal. This decision holds significant implications for users, advertisers, and the broader online community. In this article, we delve into the details of Nepal’s decision to tax Facebook and unravel the potential impact it might have on various stakeholders.

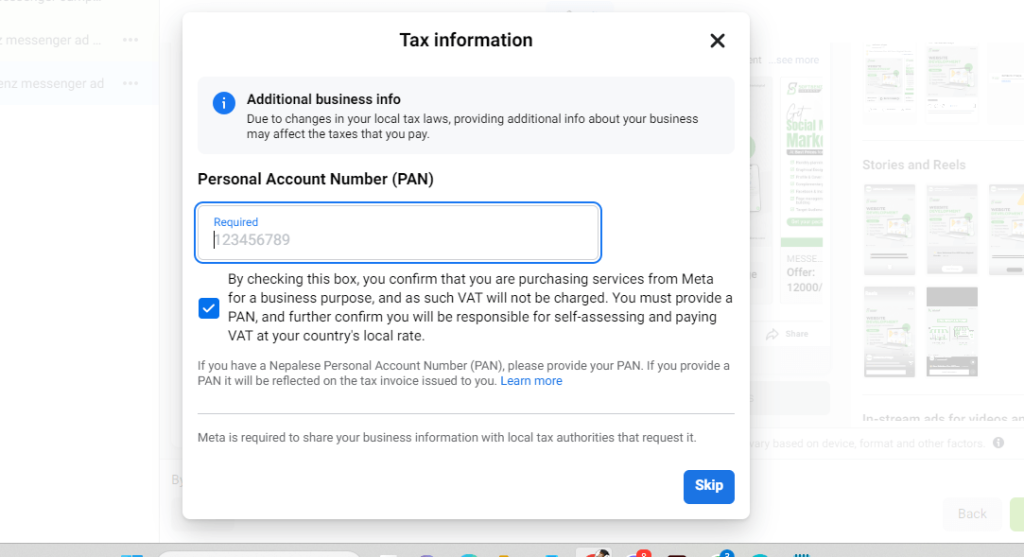

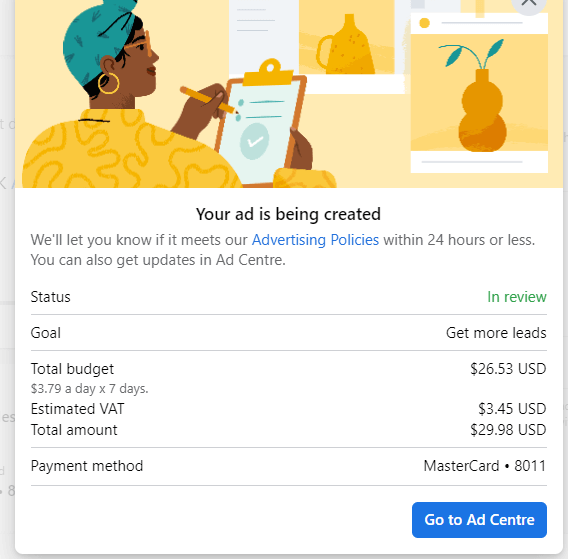

On the dawn of 1st of August, 2023, in accordance with the provisions set forth in the Finance Bill of Nepal for the fiscal year 2022-23, Meta has formally enrolled itself for a Permanent Account Number (PAN) through due processes with the Inland Revenue Department. As a result of this regulatory step, Meta will begin the practice of levying and subsequently remitting Value Added Tax (VAT) from Nepalese patrons who undertake the procurement of advertising services for reasons unrelated to commercial activities.

Commencing from the first day of August in the year 2023, Meta will augment the overall cost of your advertising procurement by an amount equivalent to the applicable regional taxation rate, in the case that the destination address indicated as the “Sold to” entity aligns with an address within the confines of Nepal. This action is undertaken in adherence to prevailing VAT regulations. Despite of the avenue for you to provide meta with your PAN specific to the Nepalese jurisdiction shall remain accessible through your advertising account settings. In the event of your submission of a PAN, the same shall be duly reflected within the invoices issued to you, thereby aligning with your tax compliance endeavors.

The Taxation Landscape

Nepal’s move to tax Facebook marks a pivotal moment in the digital sphere. As the country grapples with economic challenges, this decision is seen as an innovative step towards generating revenue. The Nepalese government’s decision to levy taxes on digital services reflects the evolving nature of our global economy. The taxation landscape is adapting to the digital age, where online platforms play a substantial role in economic activities.

Implications for Users

For the average user, the imposition of taxes on Facebook usage might lead to a reevaluation of online behaviors. While the taxes themselves might be minimal, the psychological impact could influence user engagement. Social media platforms, including Facebook, have thrived on the premise of being free to use. The introduction of taxes challenges this norm and might alter the way users perceive their online interactions.

Impact Taxes on Facebook in Nepal on Advertisers

Advertisers who utilize Facebook as a prime platform for reaching their target audience are now faced with a new reality. The cost-effectiveness of advertising on Facebook might undergo a transformation. Advertisers will need to factor in the additional financial burden posed by taxes, potentially leading to adjustments in their advertising strategies. This shift could also prompt advertisers to explore alternative digital avenues or refine their targeting to maximize returns on investment.

The Global Examples

Nepal’s decision to tax Facebook is not an isolated incident. Several countries across the world have been exploring the taxation of digital services provided by multinational corporations. The rationale behind this trend is to ensure that these corporations contribute their fair share to the economies of the countries where they operate. This global precedent underscores the need for a more comprehensive and adaptable framework to govern the taxation of digital services.

Navigating Regulatory Challenges

As the digital landscape evolves, navigating regulatory challenges becomes crucial for both governments and businesses. The taxation of digital services presents complex challenges, including jurisdictional issues, assessment methodologies, and ensuring a level playing field for all stakeholders. Governments are grappling with the need to strike a balance between fostering innovation and generating revenue, while businesses strive to align with new taxation norms.

The Road Ahead

In conclusion, Nepal’s decision to impose taxes on Facebook in Nepal reverberates beyond its borders. It underscores the evolving nature of our digital economy and the necessity for regulatory frameworks to keep pace with technological advancements. Users and advertisers alike will need to adapt to this new reality and explore strategies to make the most of their online experiences. As governments continue to fine-tune their taxation approaches, businesses must stay agile and well-informed to navigate the changing landscape effectively.

If you want to read more information about how to boost traffic on your website, just visit The Insider’s Views. Stay informed and stay ahead in the dynamic world of digital marketing and SEO.

See About Nepal value added tax (VAT) for more information

Similar Articles:

- Step-by-Step Guide: 12 Steps to Create a Marketing Plan for Business Growth

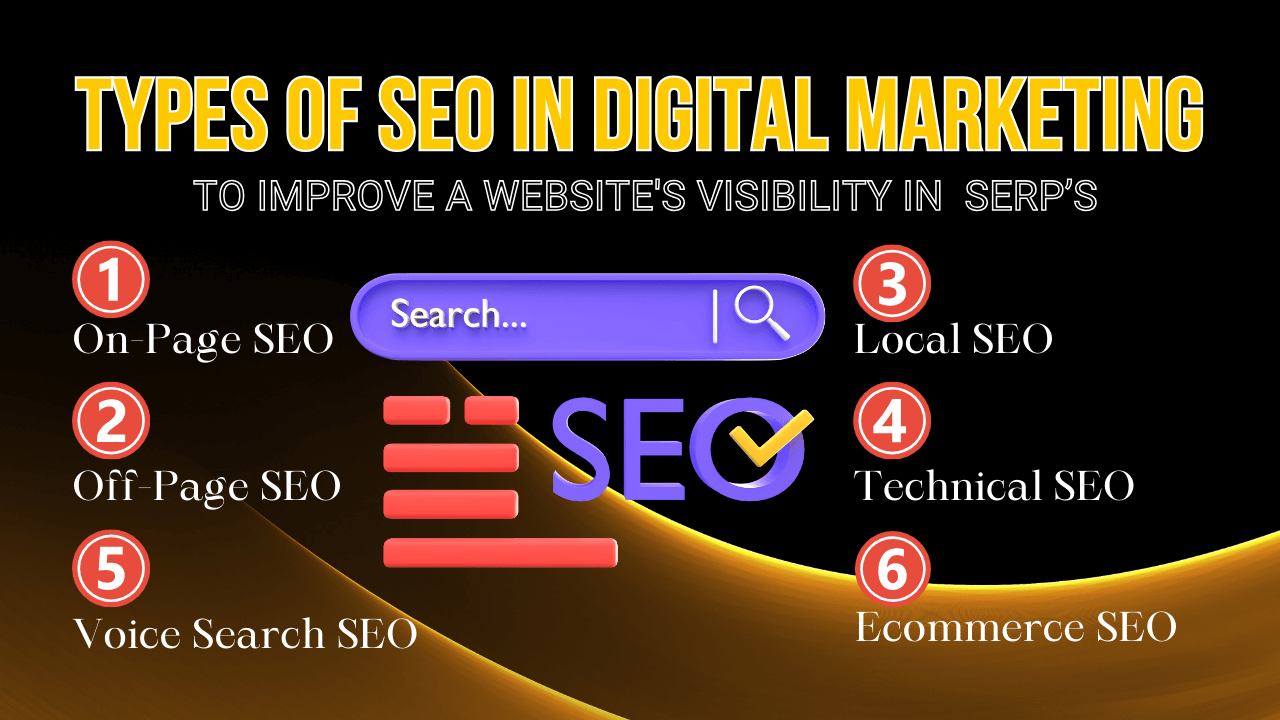

- How to Optimize for Zero-Click Searches? Is It Bad for SEO?

- Metaverse Marketing: Social Media Marketing in the Metaverse

- What is On Page Optimization? Keyword, URL, Meta Tags, ALT Tags & MORE!

![[2025 Updated] Top 10 Digital Marketing Agencies in Nepal Ranked!](https://mysticrubs.com/wp-content/uploads/2022/05/top-10-digital-marketing-company-in-nepal.png)