How to FIND MY DEAD IPHONE, EVEN IF IT’S OFF?

8 months agoShare Market | Why is Share Market growing in Nepal?

4 years ago -

Nepal Stock Exchange, in short NEPSE, is set up under the Companies Act 2006, working under the Securities Act 2007. The fundamental goal of NEPSE is to confer free attractiveness and liquidity to the public authority and corporate protections. By encouraging exchanges in its exchanging floor through the part, market mediators, for example, dealers, market producers, and so on.

Why is Share Market growing in Nepal?

1. Low loan rates and savings rate

This is likewise a central point. As banks have a bounty of stores, they have been giving out advances at as little as 8% contrasted with 13% in 2019. Many individuals have begun taking advances from banks to put resources into offers and they feel that the return will be higher than the danger if they do it right.

With reserve funds rate at 1 – 3%, specialists say, individuals have turned to putting resources into the offer market since they don’t see an incentive in keeping the cash in the bank.

2. Nepse going online

Nepse formally dispatched its web-based exchange framework in November 2018. Be that as it may, individuals, need to be up to date, and consistently put stock is going to the representatives to exchange, nonetheless, because of COVID-19, that changed as SEBON educated NEPSE to empower internet exchange.

This implied more cooperation as anybody with a telephone or a PC could exchange without going to a representative. The admittance to the offer market implied everybody began contributing. This goes inseparably with liquidity and an absence of speculation openings. As individuals were stuck at home, they began contributing gradually to offers.

This additionally occurred in India and Pakistan where the offer market began to do well after they began doing on the web exchanges.

3. Margin lending by banks

Because of high liquidity, banks began to edge (loaning cash supported by shares). As financing costs were low, different speculators in the market started to do this. Nepse without monetary movement, stale ventures, or imports, banks began distributing edge advances to intrigued speculators.

With more cash being unloaded into the market, share costs kept going up. More speculators began to edge loans from banks to make a circle bringing about the ascent in Nepal’s securities exchange.

4. Banks investing in financial institutions

Some time back, banks were not permitted to put resources into monetary establishments. Yet, since the market began to crash in 2019, they have started to put resources into loads of monetary foundations. This pattern proceeded as they saw a deal on the lookout. Some stocks were esteemed route beneath what they ought to have. These stocks were grabbed by these banks and monetary organizations. A motivation behind why portions of insurance agencies and miniature funds, which have restricted offers on the lookout, have expanded.

5. Bargains

This is a significant factor, numerous speculators guarantee. As the offer market took a dunk in 2019, numerous offers in the market could go up. Shrewd financial specialists, who had investigated these stocks, gotten them. With costs rising, numerous before long began taking action accordingly therefore the market began to go up. A decent deal stock model is NIC Asia and NCC banks alongside Nepal Reinsurance Pvt Ltd, the entirety of whose stocks have gone essentially up in the previous few months.

6. Envy and fear of missing out

Another explanation behind the market improvement is envy. Individuals had the dread of passing up an opportunity to bring in cash. For instance, A put resources into shares and acquired Rs 100,000 every month. At the point when she advises that to B or if B discovers, she will have that inclination to put resources into shares. This human instinct of jealousy has empowered many individuals to put resources into shares. This is because individuals feel that on the off chance that they don’t get into the scene at present, they will pass up the profits.

An illustration of that can be seen at banks where many individuals were lined up to open their Demat records to apply for IPOs. While just 300,000 would apply for the IPOs, NIFRA had over 1.5 million applications. This was more than 5% of the populace, which demonstrates that there is a great deal of revenue among individuals about the offer speculation.

Why is Share Market important?

The Securities Board of Nepal (SEBON) is the public authority body that manages the offer market under the Securities Act of 2006. The significant elements of SEBON are to give important protection guidelines and orders; register the protections of public organizations; direct and arrange the issue, move, deal, and trade of the enlisted protections among others. The organizations enlisted and endorsed by SEBON can list their offers in the essential and auxiliary business sectors.

Types of share market

There are two sorts of offer markets where you can exchange shares: the essential market and the auxiliary market. In the essential market, offers, debentures securities, and common assets are given straightforwardly by an organization at a base cost.

On the off chance that an organization is selling its offers unexpectedly, it is called the first sale of stock or IPO. Essentially, if an organization has its offer previously recorded in the offer market and it needs to give new offers, it discharges follow on open contribution or FPO. Third, an organization can give the right offers for the generally existing investors at the base cost.

Other than IPOs, FPOs and right offers, debentures or securities, and shared assets are additionally accessible in the essential market. Debentures are obligation instruments that organizations issue to raise their capital i.e. they are taking an advance from the general population.

These are okay protections in Nepal as the organization is legitimately obliged to pay fixed revenue, normally a higher loan cost than fixed stores, to such bonds regardless of whether they languish misfortunes over at any rate 7-10 years.

Shared assets, then again, are aggregate speculation plans by a portfolio of the board organization wherein it pools cash from speculators and puts resources into stocks, bonds, and momentary obligations. Visit Share Sansar for more updates about the share market in Nepal.

In the optional market, the investors as lawful shareowners can sell their offers that they acquire through the essential market and the auxiliary market. Nepal Stock Exchange (NEPSE) is the sole stock trade in Nepal where you can purchase and sell partakes in the optional market.

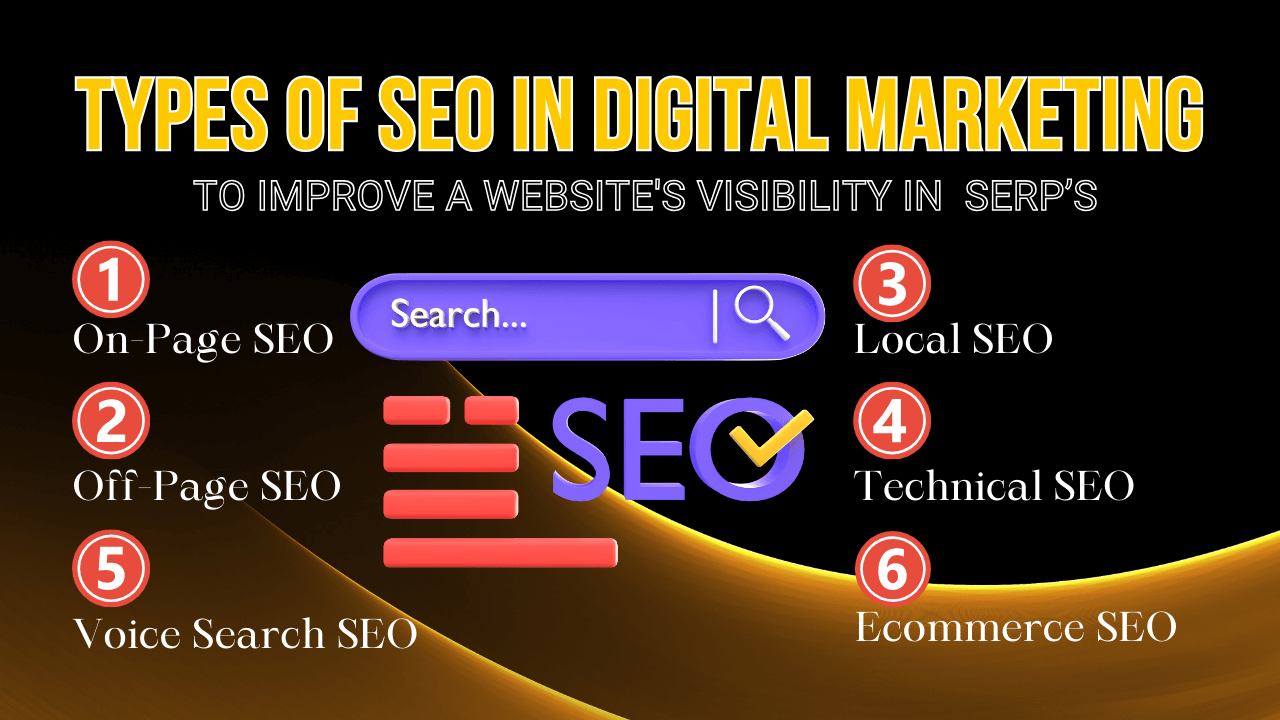

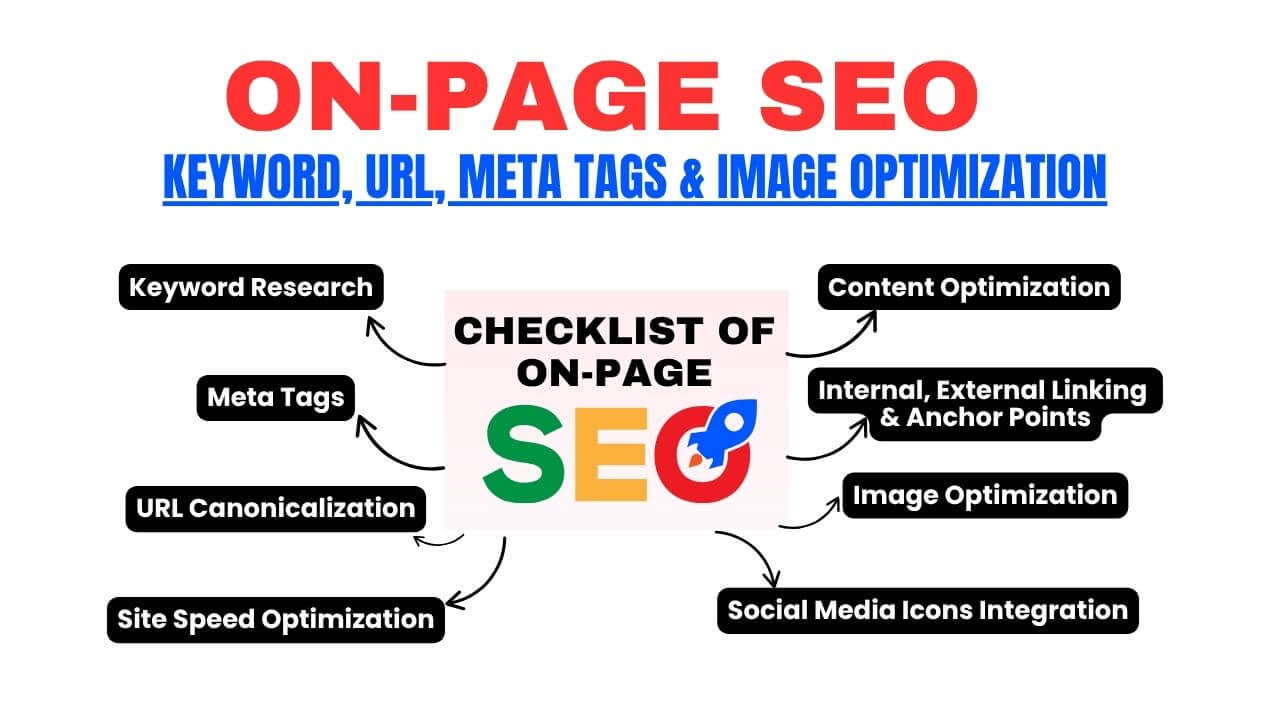

- What is On Page Optimization? Keyword, URL, Meta Tags, ALT Tags & MORE!

- Comparison of Top 10 Cloud Service Providers in Nepal 2025

- AI vs Human Copywriting: 10 Reasons Why Human Copy is Better Than AI

- Are you looking for Best Phone under 35000 in Nepal?

![[2025 Updated] Top 10 Digital Marketing Agencies in Nepal Ranked!](https://mysticrubs.com/wp-content/uploads/2022/05/top-10-digital-marketing-company-in-nepal.png)